Redfin: Out-of-Towners Pay More for Homes in Migration Destinations15301

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

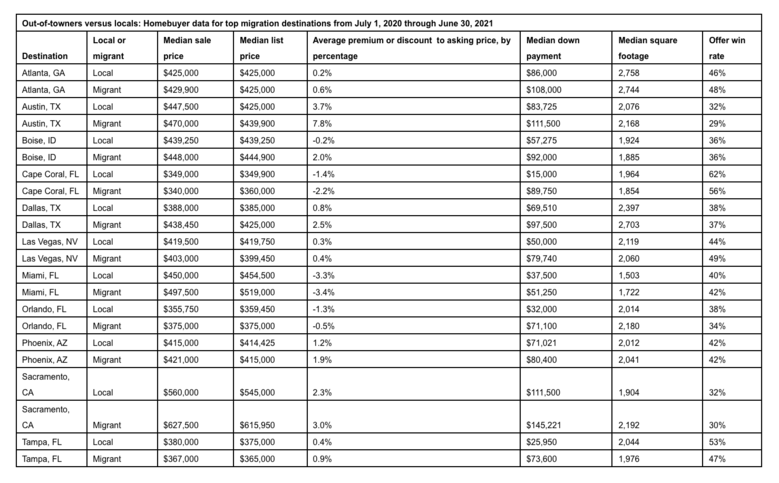

| Media Release --- Redfin Report: Out-of-Towners Moving to Austin Spend $22,500 More on Homes Than Locals Homebuyers who relocated to Austin during the pandemic paid an average of 7.8% above asking price, versus 3.7% above asking price for locals SEATTLE, July 26, 2021 /PRNewswire/ -- (NASDAQ: RDFN) — People relocating to the Austin area pay an average of 7.8% above asking price for their home, while local buyers pay an average of 3.7% above asking price, according to a new report from Redfin (www.redfin.com), the technology-powered real estate brokerage. The typical home purchased by out-of-towners in Austin sells for $470,000, versus $447,500 for locals. Out-of-towners also tend to buy homes that are priced higher from the beginning: The typical list price for a home purchased by out-of-towners is $439,900, versus $425,000 for locals. Migrants also have higher down payments than locals, with a median of $111,500 versus $83,725 for locals. Out-of-town homebuyers tend to be able to pay more than locals in popular migration destinations because they're often relocating from more expensive areas. In Austin, the seventh most popular destination for Redfin.com users looking to relocate, the typical home sold for $485,000 in June. Though Austin home prices have risen 43% over the last year, they are still significantly more affordable than the $1.59 million median sale price in San Francisco, the top origin of people moving to the Texas capitol. "People moving into Austin from out of town tend to come with a lot of cash from selling homes in expensive West Coast cities—especially the Bay Area," said Austin Redfin agent Andrew Vallejo. "And those of them who can work remotely often come with high West Coast salaries, too. They typically have a lot more buying power than locals, and they can afford to search for and ultimately buy bigger, pricier homes." The share of homebuyers moving to different metro areas has risen over the last year as remote work gives people the flexibility to relocate. The report is based on a Redfin analysis of migrant versus local homebuyers from July 1, 2020 through June 30, 2021 in 11 popular migration destinations throughout the U.S. For this analysis, migrants are buyers who searched for homes online from a different metro area than where they bought a home. Homebuyers relocating to Boise pay an average of 2% above asking price, while locals pay below asking price The story is similar in Boise, ID, another destination that has increased in popularity with out-of-town homebuyers since the pandemic began. The net inflow of Redfin.com users into Boise (number of homebuyers looking to move into the metro area minus the number looking to leave) has doubled since before the pandemic. Homebuyers relocating to the Boise metro pay an average of 2% above asking price for their home, while local buyers pay an average of 0.2% below asking price. The typical sale price for migrants moving to Boise is $448,000, versus $439,250 for locals. And out-of-towners have a bigger median down payment: $92,000 versus $57,275 for locals. Like in Austin, home prices in Boise have soared over the last year, rising more than 40% year over year to a median of $475,000 in June. That's largely due to out-of-towners moving in from expensive West Coast cities. But even with the major increase, the typical home still sells for nearly $400,000 less than the typical home in Los Angeles ($828,000), the top origin for people moving to Boise. Out-of-towners have higher down payments and pay higher premiums above asking price in nearly all of the most popular migration destinations Migrants had higher down payments than locals in all of the metros included in Redfin's analysis. Migrants bought higher-priced homes than locals in all the metros in this analysis except Las Vegas, Tampa and Cape Coral, FL, and migrants paid a higher premium above asking price than locals everywhere except Miami and Cape Coral. Redfin also analyzed data on the difference between migrants and locals when it comes to bidding-war win rates, escalation clauses and financing & inspection contingencies. There was not a statistically significant difference in offer win rates for migrants versus locals in any of the metros included in this analysis; whether prospective buyers are migrants or locals, they have a similar chance of winning a bidding war. For escalation clauses and financing & inspection contingencies, there isn't enough data to draw meaningful conclusions.  Source: Redfin To read the full report, please visit: https://www.redfin.com/news/out-of-town-buyers-expensive-homes/ About Redfin Redfin (www.redfin.com) is a technology-powered real estate broker, instant home-buyer (iBuyer), lender, title insurer, and renovations company. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 95 markets across the U.S. and Canada and employ over 4,100 people. Source: Redfin via PRNewswire |

||

| Post 1 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?